Check Payment Gateway Company Name – A Complete Guide to Verifying Legitimate Payment Providers

In today’s digital-first economy, accepting online payments is no longer optional—it is essential. However, with thousands of fintech platforms available, one crucial question every business must ask is: How do you check a payment gateway company name before trusting it with your money?

Whether you are a startup founder, eCommerce owner, SaaS provider, or digital agency, selecting the wrong payment gateway can lead to fraud, compliance issues, failed transactions, legal trouble, and financial losses.

Therefore, this guide will provide you with a deep, practical, and SEO-backed explanation of how to properly check a payment gateway company name, verify its legitimacy, compare providers, and avoid fake or unstable platforms—while also referencing BotDef and industry best practices.

🔍 What Is a Payment Gateway Company?

A payment gateway company is a financial technology provider that enables businesses to accept online payments from customers through:

- Credit & Debit Cards

- UPI & Net Banking

- Wallets (Paytm, PhonePe, Google Pay)

- Buy Now Pay Later (BNPL)

- International Cards (Visa, Mastercard, Amex)

In simple terms, a payment gateway acts as a bridge between your customer’s bank and your merchant account.

However, not all gateways are created equal. Many fake or unstable providers operate under misleading names, cloned websites, or unregistered businesses.

This is why learning how to check a payment gateway company name properly is a critical digital skill.

⚠️ Why You Must Verify a Payment Gateway Company Name

Before we go into how, let’s understand why it is necessary.

1. To Avoid Payment Fraud

Fake gateways may:

- Steal customer card data

- Disappear with your funds

- Provide fake settlement reports

2. To Ensure Legal Compliance

Legitimate gateways must follow:

- RBI or central bank rules

- PCI-DSS security standards

- KYC & AML regulations

3. To Prevent Brand Damage

A bad gateway can cause:

- Failed payments

- Refund disputes

- Chargebacks

- Negative customer trust

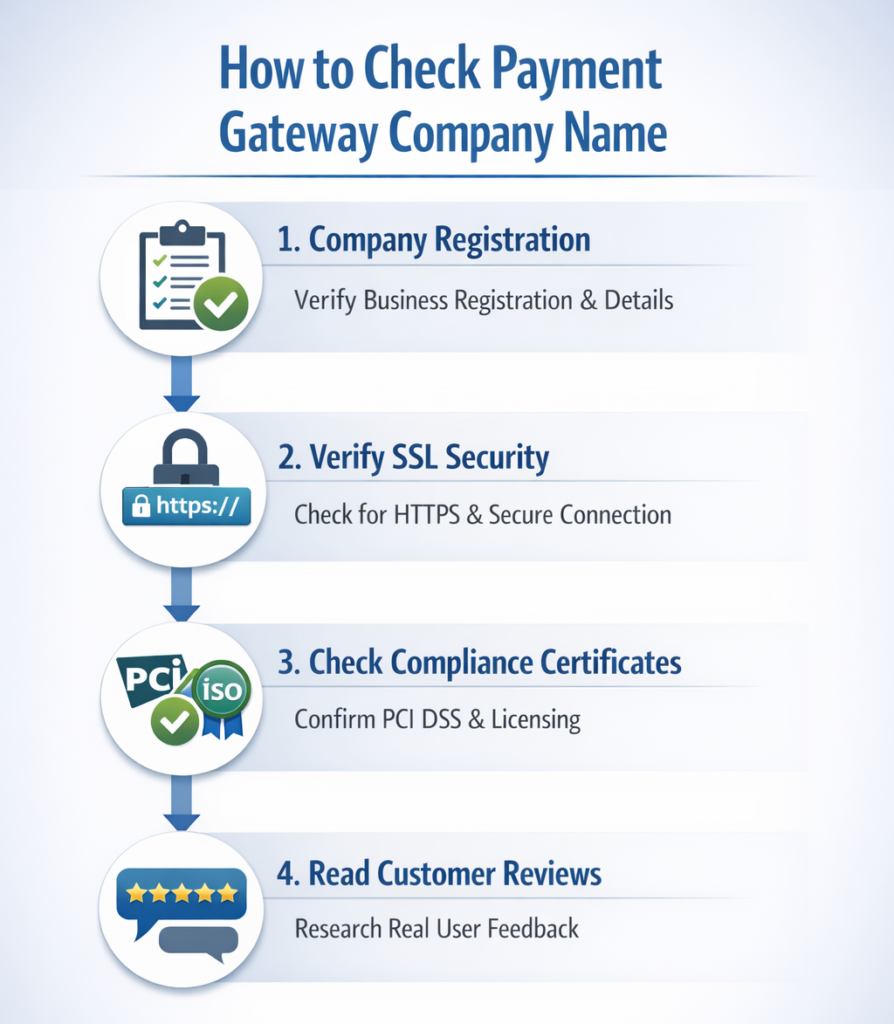

🧠 Step-by-Step: How to Check a Payment Gateway Company Name

1. Check Company Registration (Most Important)

First and foremost, search the company name on:

- India: https://www.mca.gov.in

- USA: https://opencorporates.com

- UK: https://find-and-update.company-information.service.gov.uk

You must verify:

- Legal entity exists

- Director details are real

- Registration date is not suspicious

- Address is valid

If a gateway is not legally registered, never proceed further.

2. Verify Website Domain & SSL

A legitimate payment gateway will always have:

- HTTPS (SSL encryption)

- Professional website

- Real business email (not Gmail/Yahoo)

- Terms & Privacy pages

Use tools like:

Check:

- Domain age (new domains are risky)

- Hosting country

- Company name matches domain owner

3. Check Compliance Certifications

Every real gateway must show:

- PCI-DSS compliance

- ISO 27001 (optional but strong sign)

- RBI/Bank approvals (India)

- GDPR compliance (EU)

Absence of compliance = high risk provider

🛡️ BotDef Reference: Fraud Detection in Payment Gateways

BotDef focuses on digital risk detection and brand protection, especially in identifying fake SaaS platforms, phishing gateways, and cloned fintech tools.

According to BotDef research blogs:

“More than 38% of newly launched payment platforms fail basic verification tests like business registration and compliance disclosures.”

(Source reference: BotDef – Online Scam Detection Framework)

This reinforces the need for manual verification, not just trusting ads or search results.

4. Check Real Reviews (Not Fake Ones)

Do NOT trust:

- Testimonials on their own website

- Paid review blogs

Instead check:

- Trustpilot

- G2

- Reddit fintech threads

- LinkedIn comments

Red flags:

- All 5-star reviews

- No negative feedback

- No company replies

5. Compare With Trusted Gateways

Always compare unknown providers with industry leaders:

| Trusted Gateway | Region |

|---|---|

| Razorpay | India |

| Stripe | Global |

| PayPal | Global |

| Square | USA |

| Adyen | Enterprise |

| PayU | India/Global |

If the unknown company:

- Lacks features

- Has unclear pricing

- No API docs

→ Avoid immediately.

📊 Key Features to Validate in a Real Payment Gateway

Technical Features Checklist

- REST APIs

- Webhooks

- SDKs

- Sandbox environment

- Refund & dispute system

Business Features Checklist

- Transparent pricing

- No hidden settlement fees

- Dashboard with analytics

- Real-time transaction logs

🚫 Common Fake Payment Gateway Signs

| Red Flag | Meaning |

|---|---|

| No legal company name | Scam |

| Only WhatsApp support | Unprofessional |

| No compliance page | High risk |

| Free lifetime gateway | Fake model |

| No bank partnerships | Illegal |

How Enterprises Perform Gateway Due Diligence

Large companies follow this process:

- Legal verification

- Security audit

- Penetration testing

- SLA agreement

- Pilot transactions

- Chargeback simulation

If a provider refuses any of these, it is not enterprise-ready.

Final Expert Insight

Checking a payment gateway company name is not just a technical task—it is a financial safety decision. In the era of rising fintech scams, deepfake brands, and cloned platforms, your verification process must be as strong as your revenue strategy.

If you integrate a fake or unstable gateway, you are not just risking money—you are risking:

- Customer trust

- Legal exposure

- Brand credibility

- Business continuity

Therefore, always remember:

A verified gateway builds growth.

An unverified gateway builds disaster.